Accelerated Depreciation

| Accelerated depreciation methods assume that the greatest wear and use of the asset occurs in the early years of the asset’s life, thereby “accelerating” depreciation in the early years. |

The IRS permitted accelerated depreciation methods for financial reporting in 1954. As many companies adopted them for tax purposes, the same depreciation methods were also used for financial reporting to avoid keeping separate records.

The advantage of the accelerated depreciation methods are that they permit a company to defer tax payments by taking a larger deduction up front (accelerated). Higher depreciation rates result in lower taxes earlier, but since the company will use a lower depreciation rate later, the taxes previously saved are paid at a later date.

Accelerated Depreciation Methods Illustrated

Two of the more common accelerated depreciation methods are sum of the years’ digits depreciation method and the double declining depreciation method.

The sum of the years’ digits depreciation method is calculated by dividing the number of years of useful life remaining at the beginning of the year by the sum of the years’ digits useful life, in this case 15 (1 + 2 + 3 + 4 + 5).

Sum of the years’ digits (SYD) Formula

| Number of years remaining in estimated useful life SYD |

| (Cost – Estimated salvage value) x Applicable % |

Sunny purchased a vehicle for $12,800 for company use, and estimated a useful life of 5 years with an estimated salvage value of $1,000. Each year remaining for the asset is divided by the sum of the years digits to produce the following depreciation schedule:

Sum of the years’ digits depreciation schedule

| Year | Depreciation Base (Cost – Salvage Value) |

Remaining Life | Fraction | Annual Depreciation Expense |

| 1 | $11,800 | 5 | 5/15 | $3,933 |

| 2 | 11,800 | 4 | 4/15 | 3,147 |

| 3 | 11,800 | 3 | 3/15 | 2,360 |

| 4 | 11,800 | 2 | 2/15 | 1,573 |

| 5 | 11,800 | 1 | 1/15 | $787 |

| Total Depreciation Expense…………………………………………………………………..$11,800 | ||||

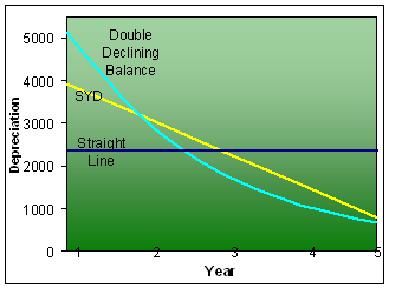

Both the straight-line depreciation method and the accelerated depreciation methods create the same total expense over the useful life of five years, but the accelerated method deducts a higher expense since it uses a higher depreciation rate earlier in the depreciation schedule:

GAAP Depreciation Methods

| Year | Straight Line Method | Sum of the Years’ Digits | Double Declining Balance |

| 1 | $2,360 | $3,933 | $5,120 |

| 2 | 2,360 | 3,147 | 3,072 |

| 3 | 2,360 | 2,360 | 1,843 |

| 4 | 2,360 | 1,573 | 1,106 |

| 5 | 2,360 | 787 | 659 (LIMITED BY SALVAGE VALUE) |

| TOTAL DEPRECIATION | $11,800 | $11,800 | $11,800 |

The two accelerated depreciation methods offer the greatest tax savings in the earlier years, with the double declining balance depreciation method offering the greatest tax savings, followed by the sum of the years’ digits method.

Both of these accelerated depreciation methods are permitted for both financial reporting purposes and income tax reporting. Using MACRS, an accelerated depreciation method preferred by the IRS and exclusive to income tax reporting, requires separate depreciation schedules for financial reporting purposes and income tax reporting.

Income Tax Depreciation is not GAAP Depreciation

Income tax methods for depreciation are not in accordance with GAAP. These depreciation methods include both:

GAAP does not permit depreciation methods and depreciation rates specific to income tax reporting for financial reporting purposes because they:

|

Accelerated Depreciation Rates and GAAP

Of course, depreciation methods for financial reporting are largely arbitrary cost allocation methods not related to the actual value of the asset. But GAAP separates depreciation methods permitted for financial reporting from tax depreciation, which includes accelerated depreciation rates such as double declining depreciation and sum of the years’ digits.

This is because, for financial reporting purposes, these accelerated depreciation rates may better represent the actual efficiency and productivity of newer equipment. Accelerated depreciation rates acceptable to GAAP are based on the estimated life of the asset and also follow the matching principle.

The larger depreciation expense in the early years is matched with the greater revenue generated when the equipment is newer and more efficient, and generating the most income. The company records less depreciation expense when the equipment is older and less efficient, thereby matching the lower depreciation expense against less income generated in the later years of the asset’s useful life.

Tax depreciation such as MACRS and section 179 are not based on the estimated useful lives of the assets and do not follow the matching principle, and are thus only allowed for income tax reporting, and not financial reporting.

Back from Accelerated Depreciation Methods to the Property Depreciation Main Page

Hi Lola –

GAAP does not consider Section 179 or MACRS acceptable depreciation methods for financial reporting purposes, so you should use separate depreciation methods for the financial reporting of the asset.

You can book the equipment as you normally would, and then use a preferred depreciation method for financial reporting of the asset. Please see the http://business-accounting-guides.com/property-depreciation/ page for more info.

For manufacturing equipment, depreciation can be debited to work in process inventory (inventory) and credited to accumulated depreciation for the equipment. When the products are completed, the costs are transferred to finished goods, and eventually to COGS when shipped (debiting COGS, crediting inventory).

Kenneth

What is the entry when we use section 179 to on a $200,000 mfg equipment for financial

Reporting. I know you can apply the full amount for taxes but not cogs.