Double Declining Depreciation

| Double declining depreciation is the most commonly used accelerated deprecation method. |

How to Calculate Depreciation Using Double Declining Depreciation

You calculate double declining depreciation by doubling the straight line depreciation rate. The double depreciation rate is then applied to the remaining book value of the asset each year. The salvage value is not subtracted during the calculation. Instead, the depreciation is limited to the remaining salvage value.

Since the straight line depreciation rate was 20% (1/5 = 20%) in this example for Sunny Sunglasses Shop, the double declining depreciation rate equals 40%.

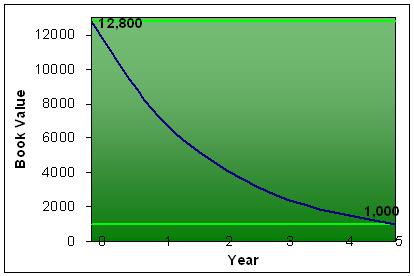

Applying this to the book value, the double declining depreciation method yields the following asset depreciation schedule:

Asset Depreciation Schedule: Double Declining Depreciation Method

| Year | Book Value Beg. of Year | Depreciation Expense (BV X 40%) |

Book Value End of Year (Beg. BV – Depreciation) |

|

| 1 | $12,800 | $5,120 | $7,680 | |

| 2 | 7,680 | 3,072 | 4,608 | |

| 3 | 4,608 | 1,843 | 2,765 | |

| 4 | 2,765 | 1,106 | 1,659 | |

| 5 | 1,659 | 659 | 1,000 (LIMITED BY SALVAGE VALUE) | |

| TOTAL DEPRECIATION……………….$11,800 | ||||

This accelerated depreciation method takes a much greater depreciation expense during the first year, over twice the straight line amount of $2,360, and 30% greater the second year, dropping below the straight line amount in subsequent years.

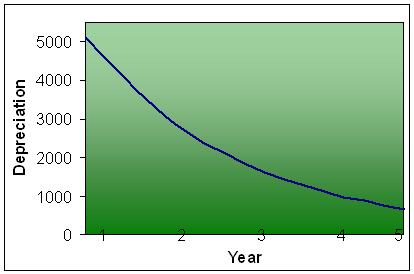

Asset Depreciation at the Double Declining Rate

The book value of the asset is also reduced at an accelerated rate in the earlier years of asset depreciation, as the graph below shows.

For financial reporting purposes, most companies would prefer to show higher profits on financial statements, while showing lower taxable income for income tax reporting. It is therefore common for companies in the United States to use one depreciation method for financial reporting purposes and a different method for income tax purposes. Many companies favor accelerated depreciation methods for income tax reporting since it lowers reportable earnings earlier.

Different companies may also use different GAAP depreciation methods for financial reporting (e.g. the straight line method, sum of the years’ digits, double declining balance, etc.), making financial statement comparability more challenging.

For this reason, companies must identify the financial reporting methods they have selected in the footnotes to the financial statements. Additionally, companies must report the cumulative financial impact resulting from a change in accounting methods, and must have a rationale basis for the change.

From Double Declining Depreciation Back to the Property Depreciation Main Page