Straight Line Depreciation

| Straight line depreciation is the simplest and most frequently used depreciation method for financial reporting purposes. |

Straight line depreciation is based on the assumption that the assets usefulness declines evenly over time. Increased activity or use of the asset has no bearing on the amount of depreciation each year since it is the same every period.

How to Calculate Depreciation Using Straight Line Depreciation

To calculate asset depreciation under the straight line method, simply divide the depreciation basis (cost – salvage value) by the estimated useful life.

Calculate Depreciation: Straight Line Depreciation Method

| (Acquisition cost – Estimated salvage value) Estimated Useful Life |

If Sunny places a vehicle he purchased for $12,800 in service as of the beginning of 2010 with an estimated life of five years, and a $1,000 salvage value, Sunny would calculate straight line depreciation as $2,360 per year:

| (12,800 – 1,000) 5 |

The straight line depreciation method can also be expressed as a depreciation rate:

| 1/Estimated Useful Life |

In this case, the depreciation rate = 20% (1/5). The depreciation rate is then multiplied by the cost less any salvage value, to arrive at the same amount: $2,360.

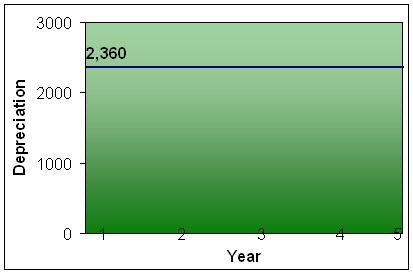

Graphically, straight line depreciation is a straight line spread over the course of 5 years, with a $2,360 depreciation expense taken each year on the income statement.

When viewed graphically, it is easy to see where the straight line depreciation method gets its name. The depreciation expense holds steady during the time period, resulting in a linear graph.

Similarly, the book value of the asset declines steadily over the course of the asset depreciation period, since an even amount of depreciation is taken each period. Notice that the depreciation is taken from the total acquisition cost of $12,800, not the depreciation base of $11,800.

The accounting journal entry at the end of each year is entered as:

Depreciation Expense, Company Vehicle

| Account and Explanation | Debits | Credits |

| Depreciation Expense | $2,360 | – |

| Accumulated Depreciation | – | $2,360 |

| To record annual depreciation expense of company vehicle. |

At the end of year five, the book value equals the salvage value of $1,000. The company vehicle is listed on the balance sheet at the original acquisition or historical cost, less the accumulated depreciation amount:

| Vehicle | 12,800 |

| Less Accumulated Depreciation | (11,800) |

| Vehicle, net | 1,000 |

Accumulated depreciation is a contra account to the property plant and equipment account that reduces the asset balance to the carrying value of the asset, or its historical cost less the total accumulated depreciation.

Back from Straight Line Depreciation to the Property Depreciation Main Page

beautiful:)